staking

Introduction

Assuming you have a picture of what Cardano is, I would like to tell you more about what staking is, what my role and responsibilities are as a stake pool operator (SPO), and why you should delegate your ADA to a stake pool. To clarify, ADA is the cryptocurrency used on the Cardano blockchain to facilitate the operating of the network, such as for the payment of transaction fees. Besides, ADA can be bought at cryptocurrency exchanges to invest in the Cardano project.

Proof of work versus proof of stake

Let’s start by explaining the essential difference between Cardano’s ‘proof of stake’ consensus mechanism and ‘proof of work’ consensus mechanisms such as used by Bitcoin. Simply put, a consensus mechanism in blockchain technology is about how information stored in the form of blocks is verified and added to the blockchain, or even more simply: how we agree on what is the truth within a decentralized network of computers.

In both consensus mechanisms, the people involved in producing the blocks are rewarded for their effort, however, the incentives are quite different. In order to gain the rights to produce a block at a specific time, the proof of work protocol requires you to solve a cryptographic puzzle faster than anyone else, since only the winner (the computer lucky enough to crack the puzzle) gets rewarded. This has led to massive competition and the construction of infamous mining facilities, because the more computers you have, the more chance of mining a block. Needless to say, this has caused a huge amount of energy waste; mining facilities consume the same amount of energy as entire countries. Moreover, due to economies of scale, the mining of these blocks has come into the hands of relatively few people, making the blockchain more centralized, and thus, less secure (see Q3 of the FAQ).

On the other hand, Cardano’s proof of stake protocol distributes the rights to produce blocks to stake pools based on the amount of stake delegated to them, which is simply the amount of delegated ADA. Stake pools are publicly visible and anyone holding ADA is able to delegate their stake to a stake pool of choice. In turn, the owners of the stake pools, the SPOs, ensure that their pools are functional, meaning that they are able to produce blocks. Both SPOs and delegators are rewarded whenever a stake pool produces a block as decided by the algorithm, and thus both have an obvious incentive to ensure pools are functioning and correctly participating in the protocol. On top of that, this mechanism removes the incentives for unsustainable competition and thus results in a far higher energy-efficiency than Bitcoin as well as a more decentralized and secure network.

Delegation, block production and distribution of rewards

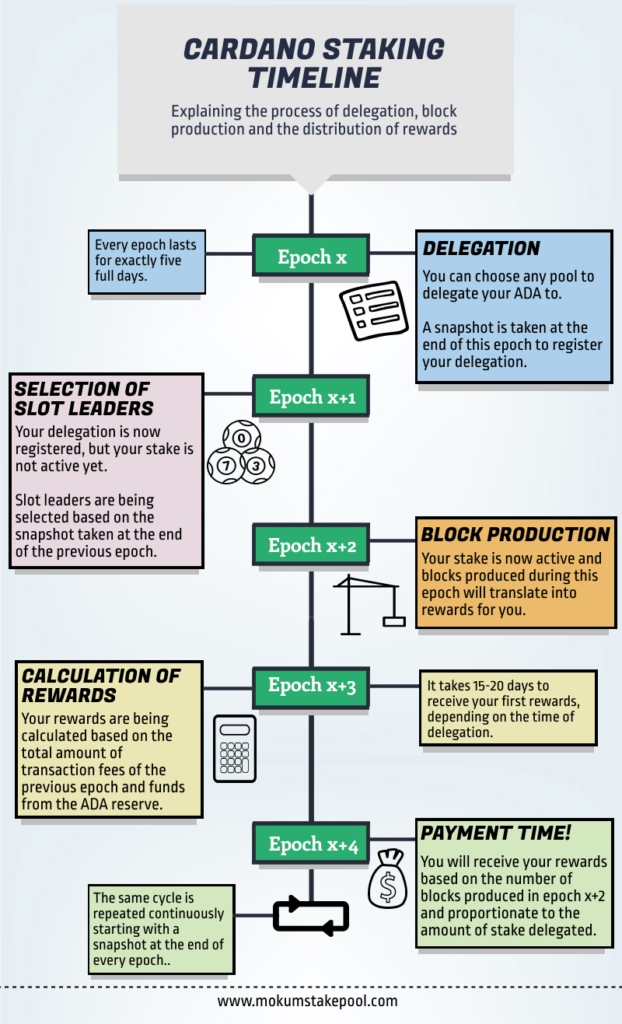

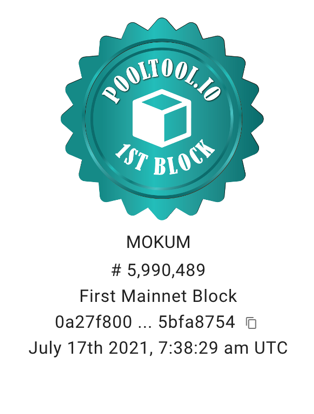

In a way, you can compare delegating ADA to a stake pool to participating in a lottery. You don’t actually transfer your ADA to a stake pool, so there is no risk of losing it, but you increase the probability for the pool to produce blocks and you receive rewards in return. Every epoch (a period of exactly 5 days), stake pools are given a certain amount of ‘opportunities’ to produce blocks for specific slots (one slot translates to one second). Small pools, having a lower stake, will not be elected as slot leaders as often (given the opportunity to produce a block), but when they do produce blocks, they also generate significantly more rewards for their delegators, since rewards are distributed proportionally to the amount of stake delegated. To illustrate, Mokum Stake Pool has been active since epoch 275, was selected as slot leader for the first time in epoch 278 (at 17-07-2021, 7:38:29 am UTC) and also successfully produced its first block at this time!

After having produced one or more blocks in a given epoch, the amount of rewards for the stake pool is calculated in the next epoch (epoch 279 in my example) and is composed of the total amount of transaction fees paid during the epoch of block production (epoch 278) and from funds of the ADA reserve. Finally, at the start of the epoch after that (epoch 280) rewards are distributed to the stake pools and their delegators.

Of these rewards, an obligatory minimum of 340 ADA is given to the SPOs as operational costs for each epoch that blocks were produced. On top of that, SPOs charge a margin fee of a certain percentage (2% for Mokum Stake Pool) on the rewards after deduction of the operational costs, which is defined as the pool’s profit. The remaining rewards go to the delegators in proportion to their delegated stake.*

In order to prevent stake pools from becoming too large and to promote decentralization, pools with a stake higher than 63.3 million ADA will forfeit a part of their rewards and, in turn, their delegators will miss out as well. Furthermore, SPOs are required to pledge a certain amount of ADA in their own pool to show commitment to their pool and to prevent the creation of many pools by the same operator. In line with this, SPOs with a high pledge rightfully gain more trust by showing that they put a lot of skin in the game.

*For example, if a pool receives 1340 ADA as rewards for its produced blocks, 340 ADA are subtracted as operational costs and given to the SPO. From the remaining 1000 ADA, the margin fee of 20 ADA (2%) is also given to the SPO and the eventual 980 ADA are distributed among the delegators.

Role and responsibilities of Stake Pool Operators

So, in a nutshell, SPOs are facilitating the development of the Cardano blockchain, including all its revolutionary features, by ensuring its functionality and the stability of the network. In addition, and in my opinion, it also comes with a few responsibilities. First and foremost, we are responsible for creating and maintaining a reliable and secure pool, which means that elected slot leaders should also produce blocks in the corresponding slots. For this, high uptime is very important and pools should not be offline for more than a few hours during maintenance, which should be scheduled during a time they are not selected as slot leader in order to avoid missing any blocks. You can verify uptime of some stake pools on PoolTool (height of the pool should be in green).

Secondly, SPOs should be transparent and honest about their fees and potential donations. This means that we should not suddenly raise the value of operational costs or the margin fee with a considerable amount. Generally speaking, operational costs significantly higher than 340 ADA or a margin fee of more than 5% (or even 3%) are considered unreasonable. Regarding these fees, SPOs should be clear about their intentions towards their delegators. The same goes for donations by mission-driven pools; it should be clear how donations are calculated and proof of donations should be provided.

Why you should delegate your ADA

The main incentive for delegating your ADA to a stake pool is the Return on ADA (ROA). Annually, and on average, you will earn about 3-5% interest, depending on a pool’s luck and its parameters. In case you keep your ADA at an exchange and do not delegate yourself, the exchange will delegate your ADA, while you miss out on the rewards. Some exchanges do offer the option to delegate on your behalf, but will still take a significant part of rewards you could earn by staking yourself. Moreover, delegating is complete safe and there is no risk of losing your ADA. You do not actually transfer your ADA to a stake pool, but you delegate your rights to participate in the protocol, while your ADA remains safely in your wallet.

Finally, by delegating your ADA, you contribute to decentralization of the network. Big exchanges operate multiple pools, while charging high fees, and this results in the concentration of stake. By delegating to smaller pools, and thus moving your stake away from big exchanges, you contribute to decentralization and the security of the network.